ThaiBev’s Tax Policy is founded in the principles laid out in the overall vision 2020, mission, values, sustainability goals and good corporate governance principles that have already been implemented in the ThaiBev Group. 2020 is the final year of ThaiBev’s six-year business plan (2015 – 2020), which was implemented to drive the business towards Vision 2020. ThaiBev has grown significantly during this period becoming ASEAN food and beverage industry leader. ThaiBev plans to continue this stable and sustainable success with PASSION 2025.

PASSION 2025 reflects ThaiBev’s commitment, determination, and dedication to emerge stronger in order to achieve the vision of PASSION 2025. ThaiBev will transform its business operations through 3 domains:

– building new capabilities and business opportunities

– strengthening the core businesses for market leadership positions

– unlocking potentials of the Group to create maximum value

(Ref. Annual Report 2023)

In support of our overall business strategy and good corporate governance objectives, we pursue a tax policy that is principled, transparent and sustainable in the long term. We have established principles governing our tax policy and related tax practices which have been the result of a longstanding ThaiBev experience and which are directed by ThaiBev’s Board of Directors, and are annually reviewed and approved by the meeting of Group Finance and Accounting which is chaired by CFO which allows ThaiBev’s business to be conducted according to its core business plans, the shareholders’ resolutions in an honest manner under the law and ThaiBev’s objective and consequently accomplish our commitment and responsibility towards our stakeholders. Our tax policy and related tax practices are set out below:

Tax Codes of CONDUCT Practice

contains principles that aim to achieve sustainable and competitive taxation and sustainable value and growth including good corporate tax citizenship with added value for society. Tax Code of Practice sets out clear articulation of our tax governance framework and ThaiBev’s perspective on tax risk. Our tax principles are set out below.

We act at all times in accordance with all applicable laws and relevant international standards and we aim to comply with the spirit as well as the letter of the tax laws in the countries in which the company operates.

Our Tax Code of Practice is based on our corporate governance as laid out in our Business Ethics of Thai Beverage Group which requires that our business be transacted in accordance with a high standard of corporate conduct appropriate to our standing as a major company with worldwide operations. All ThaiBev’s personnel have the responsibility to adhere to the Tax Code of Practice, so that ThaiBev achieves its objective of upholding ethical conduct and maintaining ethical standards.

We aim to pay an appropriate amount of tax according to where value is created within the normal course of commercial activity. Any intragroup pricing is aimed at achieving a commercial market price. We have conducted a transfer pricing documentation and benchmarking study for our intragroup transactions to ensure that all the prices and considerations are fairly and commercially allocated by the comparable situations among the Group and been on the path of being under significantly progress in implementing a group transfer pricing policy to ensure all the intragroup transactions are align with the Arm’s Length principle under its respective domestic jurisdiction regulations and transfer pricing laws and in the context of the international tax environment in order to demonstrate that all the respective transactions have appropriately and commercially been charged within the range of the prices those parties who are not related to each other should carry a business so and to emphasize a maximum prudence and transparency in ThaiBev’s Group.

ThaiBev Group has fully implemented this principle by preparing transfer pricing documentation for the entire group and subsidiary companies within the non-alcoholic beverage business from the 2019 accounting period onwards. For the 2023 accounting period, ThaiBev has already included beer and spirits factories and will include other businesses in the future.

Our tax structuring is always based on sound commercial rationale with a substantive presence in each jurisdiction. We never participate any tax fraudulent, contrived or abnormal tax structures shifting profits to secrecy jurisdictions or so-called tax havens. Furthermore, we will neither make complex tax structures where the primary objective is accessing tax benefits and the main purpose is tax avoidance nor execute any business structures given to any aggressive tax planning and/or with tax benefit driven intentions proposed with or by any other parties. We always commit to exercising a tax structuring in the compliance with the existing requirement and regulations as well as suitability in the new climate of ethical business practice and OECD’s BEPS environment to ensure that we have adapted to the dynamics of the change. We have responsibility to our shareholders to be financially efficient and deliver a sustainable taxation that enhances shareholder value.

In line with the objective of tax efficiency, we will seek to make use of legally available tax incentives, within the context of sound and sustainable business decision-making to compete in the market, in where countries in the South East Asia region, mainly consisting of developing and un-developed countries, commonly provide tax incentives in exchange for a business establishment and a stimulus of their economics and decreasing their domestic un-employment rates. Incentives may include tax holidays, accelerated asset allowances or other incentives. All are in the context of national or local tax policy and would generally be available to any business that meets the relevant criteria. These incentives may influence our business decision making but are only one of a range of economic factors taken into account. Generally, the tax incentives are granted with a restricted period of time to compensate with increasing other taxes collection (e.g., employment tax and consumption tax).

We respect the right of governments to determine their own tax structures, rates of tax and collection mechanisms. We seek an open and constructive dialogue with the tax authorities in pursuit of professional, constructive and transparent working relationships.

Tax Risk Management and Tax Control Framework

We focus on risk governance includes the identification and management of all material business risks, including but not limited to strategic, financial, operational, reputational, and environmental, information technology to ensure that ThaiBev operates in compliance to legal requirements.

We are fully compliant with tax laws and regulations in all jurisdictions where we operate. And in this context we aim to manage our tax risks including tax consequences due to changes in government tax policies or administrative tax practices. This encompasses maintenance of documented policies and procedures in relation to tax risk management and completion of thorough risk assessments in all its taxation affairs. This includes, among others, compliance, operational and external reporting risks.

We commit to act responsibly in relation to our tax affairs. This means that we comply with the tax laws and regulations of each region in which we operate. Where tax laws do not give clear guidance, prudence and transparency shall be the guiding principles. We furthermore commit to be globally compliant in timely, accurate and complete filing of tax returns and striving to avoid adjustments, fines and interest costs. Our economic contribution, of which tax forms a part, is important and we aim to ensure that we pay the right and proper amount of tax in each region in which we operate. Operational controls apply to all processes relating to the management of tax liabilities for which tax is accountable.

We are committed to appropriate internal and external tax monitoring and reporting and accurate representation of current and deferred tax expenses.

We acknowledge tax as a relevant factor in the meeting of Group Finance and Accounting which is chaired by CFO in decision making process. Tax risks are being monitored and reviewed on a structural basis and form a recurring item on the meeting of Group Finance and Accounting’s agenda. Management controls are in place and ensure that, at the highest level, tax is aligned with our tax policy in a controlled and standardised manner. They encompass the authority, objectives, principles, rules, and related assurances that underpin tax activities and establish boundaries for tax.

We are committed to effectively monitor and manage compliance and reputational risks related to our tax affairs. We periodically review the quality and integrity of tax arrangements, as well as the accuracy and comprehensiveness of tax data, tax returns and reported results regarding tax provisions, exposures and deferrals.

We are committed that our employees truly understand the content and meaning the Tax Code of Practice; at every level, our personnel are bound to accept and follow the code to engender knowledge and understanding and to instill tax risk management into awareness of all tax practitioners who are directly responsible for ThaiBev’s taxation including giving a direction to other divisions on tax related issues and thereby aiming for tax risk management to be part of corporate culture. We periodically provide special trainings in tax risk management in order to understand risk factors, risk process and management tools used to address risk consistently.

ThaiBev has been in a continuing process of improving and implementing tax risk management in the company and the development of Tax Control Framework is part of that continuous commitment and process in the years to come which includes internal processes, roles, responsibilities, reporting and risk mitigating policies for ThaiBev business transactions and their potential tax consequences.

In order to operationalise our Tax Risk Management commitments, ThaiBev has introduced a Tax Control Framework (“TCF”) including internal processes, roles, responsibilities, reporting and risk mitigating policies for ThaiBev business transactions and their potential tax consequences. ThaiBev’s TCF has been being developed to ensure that all commitments included in Tax Code of Practice, Tax Risk Management and Tax Transparency are aware of and covered in the internal risk management process.

ThaiBev aims to be "in control" of all tax issues, being able to detect, document and report any relevant tax risks in a timely way, and bringing all tax processes in the scope of the Tax Control Framework. In this way the ThaiBev Tax Control Framework should enable ThaiBev to identify, mitigate, control and report tax risks internally and when necessary, externally.

The main focus is on managing the risk associated with taxes for its Thai and foreign entities. This includes keeping current with tax laws and changes as they occur, improving controls over tax financial reporting requirements, managing the global tax audit activity, determining that compliance with tax requirements occurs in every jurisdiction, providing access to proper expertise in each jurisdiction and accurately reporting global tax accounts by a jurisdiction.

ThaiBev supports the increased focus on financial reporting and enhanced demand for improved transparency by investors and shareholders, public and governments, stakeholders and management alike.

ThaiBev has developed a consolidated tax function by transforming individual company’s tax compliance functions into the group’s specialized unit tax center to monitor and control all tax roles and responsibilities in order to mitigate any possible tax risk from operations, interpretation and compliance, if any. ThaiBev has recently established the Central Tax Group Team to oversee the group of foreign subsidiaries and this team is responsible for direct reporting to the CFO. This has driven ThaiBev into the pace to ensure all tax works are compliant along with the business in rapidly changing environment in order to always achieving the business and sustainability goals. ThaiBev’s TCF should result in an effective, efficient and transparent tax function in which for each tax process in the organisation, the roles and responsibilities are defined and procedures, process (and tools) are made available and properly documented and reported.

TAX TRANSPARENCY STATEMENT

Our tax communication to governments is based on transparency fulfilling all statutory disclosure requirements on taxation and demonstrating our transparency and accountability as a part of our good tax governance. Our clear and transparent tax policy are disclosed in the public domain accompanied by ThaiBev regional tax report.

For ThaiBev, a good corporate citizenship includes excellence in tax governance, tax accountability and tax transparency building trust with societies and stakeholders. We are committed to open and transparent principle-based approach towards taxation.

- For ThaiBev, this means, first of all, transparency to tax authorities where full disclosure will be given to fulfil all regulatory requirements in all jurisdictions we operate in.

- This includes information necessary to properly understand entries in a tax return and information specifically requested during tax audit enquiries. In this context, we ensure that proper documentation is retained to meet local tax requirements.

- We are committed that our employees truly understand the content and meaning of the tax code of practice; at every level, ThaiBev personnel are bound to accept and follow it. ThaiBev has a duty to maintain transparency in its operations and protect the interests of its shareholders by considering tax risk factors, both present and future.

- We are committed to tax transparency responsibilities towards our stakeholders in the widest sense in line with our sustainability approach. In that spirit of transparency and continued disclosure we have decided to publish our tax policy.

- We are transparent about our approach to tax and will put forward understandable, timely and transparent communication about our tax policy. We believe that this tax transparency is a cornerstone of good tax governance.

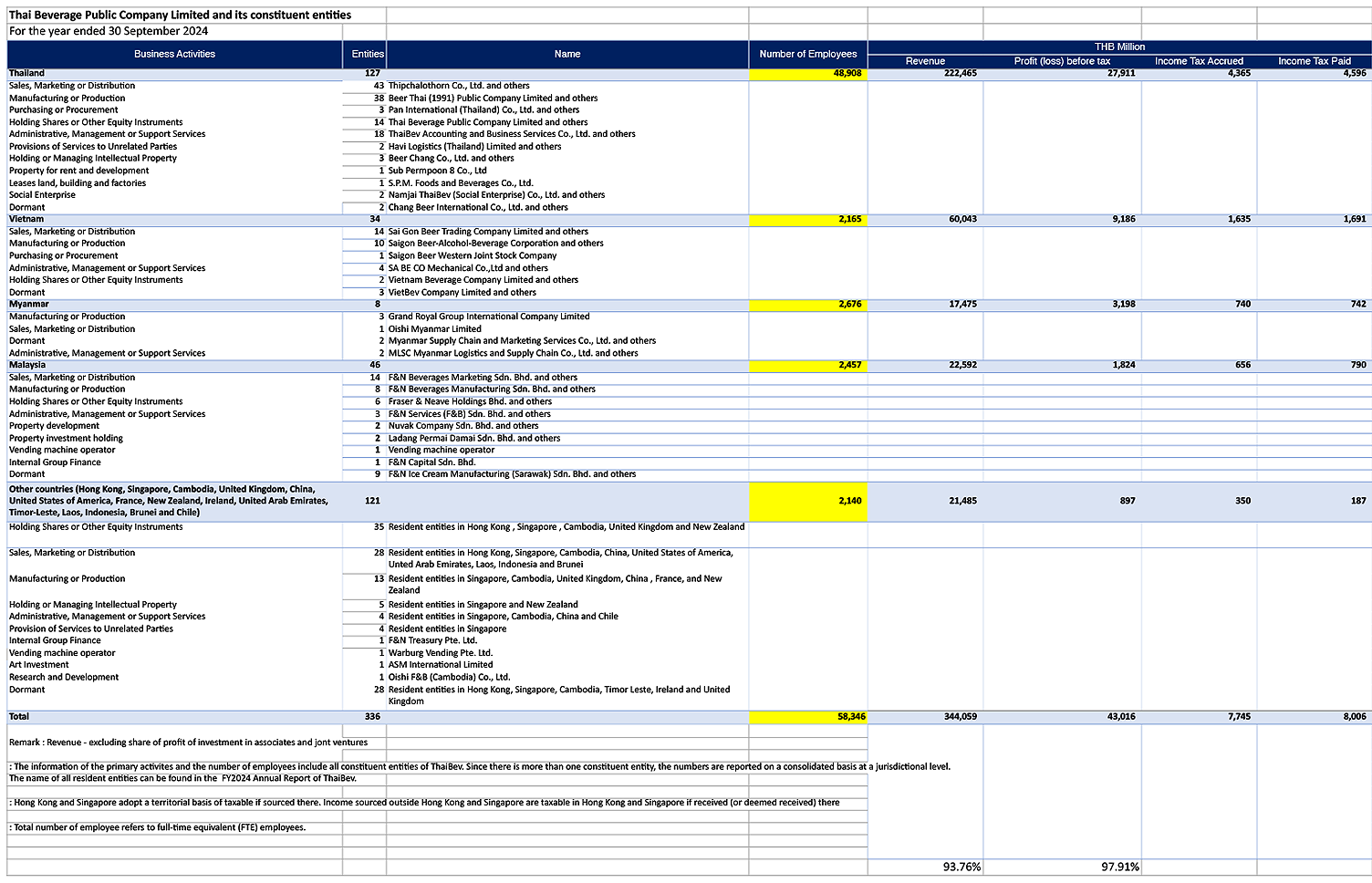

- Furthermore, we support efforts to ensure that companies are appropriately transparent on their economic contribution. In order to provide greater insight and clarity, we are committed to transparency and accountability in disclosure on taxation in ThaiBev regional tax report indicating revenue, operating profit and taxes paid.